Visa Cash Back Card

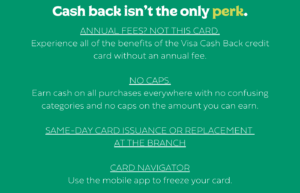

Introducing the new Visa Cash Back Credit Card! Every time you make a purchase with your cash back credit card, you’ll earn a percentage back in cash. Yep – that’s real money back to you!

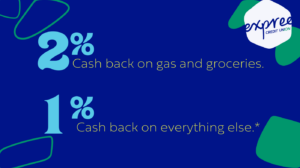

Get 2% cash back on gas & groceries, 1% cash back on everything else*

You do you and earn more cash back.

Frequently Asked Questions

What is cash back credit card?

Expree’s Cash Back Visa allows cardholders to earn back a percentage of the money they spend with the card.

How do I earn cash back from an Expree Cash Back credit card?

To earn rewards, simply make purchases with the card. You’ll earn 2% cash back on gas and groceries and 1% cash back on all other purchases. Non-purchase transactions, such as cash advances and balance transfers, are not eligible.

How often is cash back awarded?

With the Expree Cash Back credit card, the total cash back amount is automatically deposited into your primary savings account at Expree Credit Union each month.

How will cash back be redeemed?

No action is required to redeem cash back earnings. The full amount earned is automatically paid out each month.

How can I spend my cash back?

However you’d like. Once your cash back earnings are deposited into savings, they can be used for virtually anything.

Can I use cash back to pay my statement balance?

Yes! Simply transfer the funds from savings to your credit card account.

Will my cash back rewards expire?

No. They are automatically paid each month.